Strategic Capital. Proven Framework.

Our investment criteria are designed to align with experienced sponsors and developers, focusing on disciplined underwriting and downside protection.

Small Balance Preferred Equity Platform

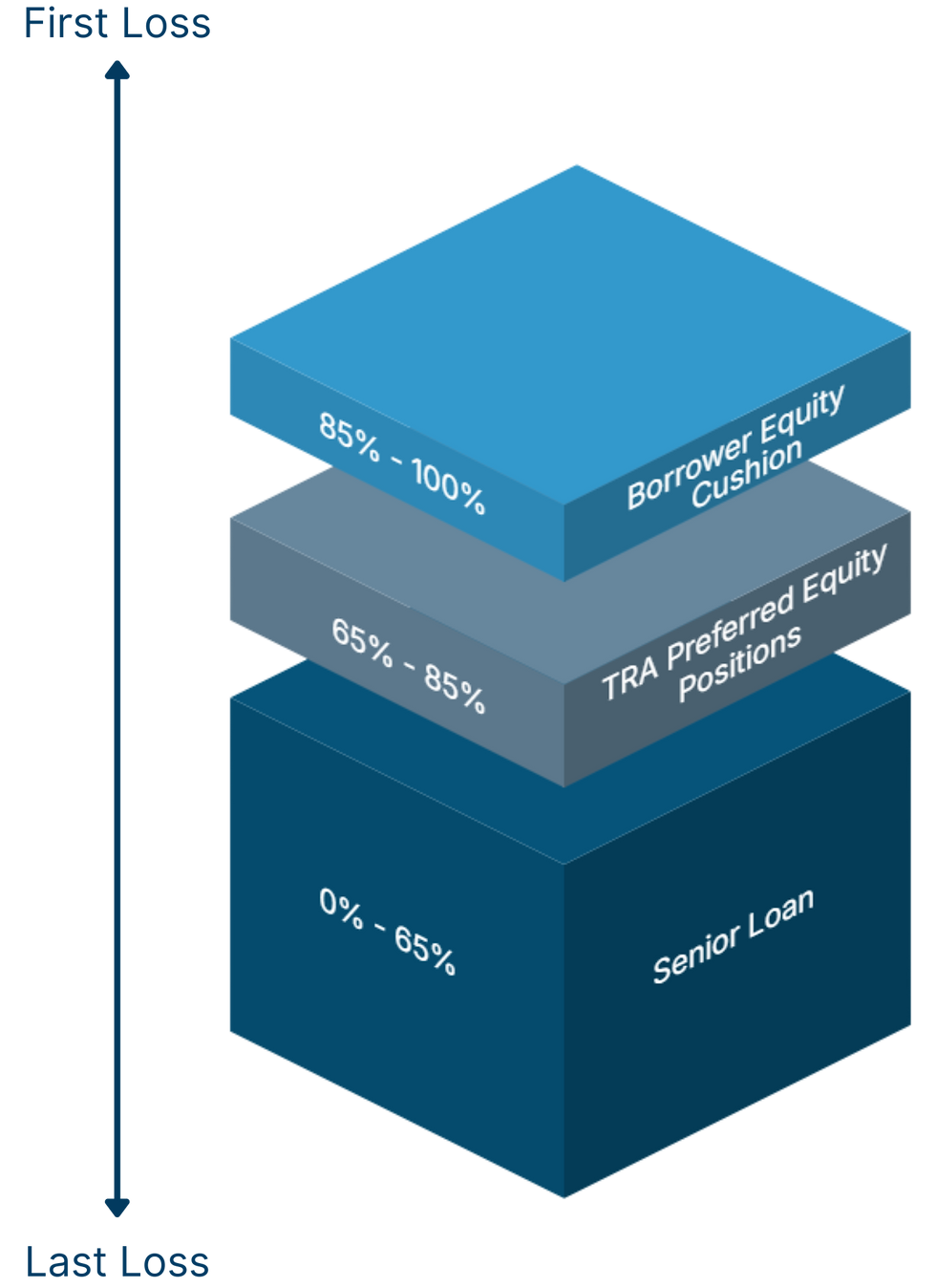

Flexible capital bridging the gap between senior debt and common equity.

TRA provides flexible capital solutions that help multifamily owners and operators bridge financing gaps with speed and certainty. Our Small Balance Preferred Equity platform targets the underserved $2 - $8 million segment where institutional capital rarely participates. We offer sponsors creative structures, execution certainty, and long-term alignment to optimize outcomes for investors and partners.

Joint Venture Equity

Long-term partnerships built on aligned interests.

TRA invests up to $8M in LP and Co-GP equity for multifamily and select commercial projects. Our flexible capital allows us to structure deals that support acquisition, development, or recapitalization.

Key Parameters

Up to $8M investment size

LP and Co-GP equity structures

Focus on multifamily; select other asset types considered

Flexible deal structures aligned with sponsor goals

Designed for long-term partnership and shared value creation

Our Process

1

Evaluate

2

Structure

3

Commit

4

Partner

5

Realize

Current Investment Parameters

Investment Structure:

Preferred Equity & Mezzanine Debt

Property Type:

Multifamily

Deal Profile:

Refinance Shortfall, Extension of Senior Debt, Acquisition

Duration:

Coterminous with Senior Debt

Investment Amount:

$2 - $8 Million

LTV Constraints:

85%

Accrual Rate:

14+%

Minimum Multiple:

2 Years

Origination Fee:

2%

Our Process

1

Review & Align

2

Underwrite & Structure

3

Commit Capital

4

Monitor Progress

5

Exit & Realize

Evolution of Preferred Equity Investments

Capital markets have evolved to create a particularly attractive environment for TRA's Small Balance Preferred Equity Platform.

Post-pandemic liquidity bubble (2020 - 2022)

-

Low interest rates

-

High property values

-

Readily available equity capital

Liquidity vacuum (2023-2025)

-

Higher interest rates, lower loan proceeds

-

Reduced property values

-

Lack of equity capital

RIGOROUS DEAL SELECTION PROCESS

The extraordinary demand for Small Balance Preferred Equity allows TRA to be very selective on portfolio investments for its Preferred Equity Platform. Risk factors created by qualitative deal characteristics must be mitigated by substantial compensating factors.

QUALITATIVE DEAL CHARACTERISTICS

-

Market: growing regions of the United States with detailed analysis of supply pipeline

-

Sponsor Experience: sponsors with substantial local apartment

-

Property Condition: preference for newer properties

-

Senior Debt: preference for lower priced, fixed rate debt

-

External Risk Factors: evaluation of insurance premiums, flood risk, and other environmental factors

QUANTITATIVE DEAL METRICS

-

Attachment Point LTV: Senior debt typically limited to 65% to 70% of property value

-

Detachment Point LTV: Pref equity last dollar typically limited to 75% to 85% of property value

-

Debt yield: Property NOI of 7%+ of TRA effective basis (adjusted based on local market cap rate)

-

Debt service coverage ratio (DSCR): ~1.10x, ensuring stable distributions through market cycles